What Is a Structured Settlement? Structural settlements are defined | How do structured settlements work?

A structured settlement is an arrangement where individuals receive periodic payments over time rather than a lump sum, which is often the result of legal proceedings.

These settlements offer financial security, stability and tax benefits. While structured settlements are facilitated by annuities, they are tailored specifically to meet the needs of the recipient.

What Is a Structured Settlement? | Structural settlements are defined.

A structured settlement is a type of court settlement that is paid annually rather than as a one-time, lump-sum payment. An orderly settlement generally provides tax benefits to the receiving party while also providing some savings to the paying party.

Definition of an organized settlement next to a graphic of a money bag and gavel

SPREAD OUT

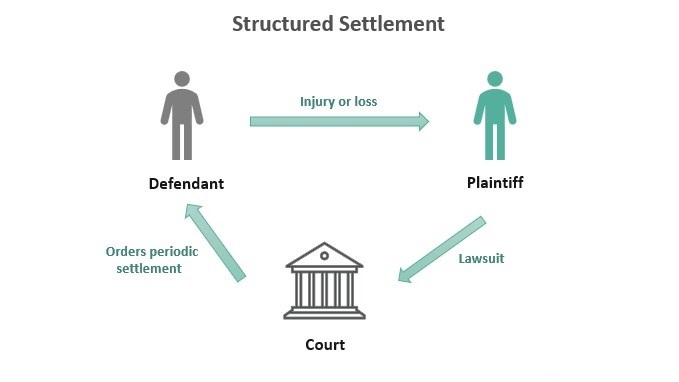

Structured settlements are relatively simple. Many civil lawsuits result in one person or company paying another to right a wrong. Those found at fault may agree to settle on their own, or be forced to pay if they lose a court case.

Structured settlements are usually voluntary arrangements between the defendant and the injured party—both parties usually have a say in whether to set up a structured settlement or opt for a lump sum payment.

If the amount of money is small enough, the wronged party may choose to receive a lump sum. However, for larger amounts, a structures settlement annuity is usually arranged. Various factors often influence this decision, including the financial needs and preferences of the recipient, future financial planning and tax considerations, and the overall negotiation process between the parties involved.

When an orderly settlement is orders, the party at fault puts the money toward an annuity — a financial product issued by an insurance company that guarantees regular payments over time.

The agreement also details the series of payments that the awarded party will receive as compensation for the damages caused to them. Spreading the money over a longer period provides a better guarantee of financial security because the recipient cannot quickly spend the series of payments.